China’s New Home Prices Plunge The Most Since October 2014

So much for that Chinese housing “bailout”, which we correctly warned would be woefully insufficient.

A slew of data published early Monday local time, showed that among various other economic measures, China’s housing slump deepened in May and triggered new calls for the government to pump cash and credit into the economy, while industrial output, which has kept growth on track, fell short of forecasts.

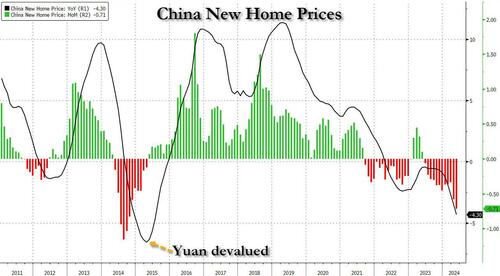

New home prices – the most important indicator of middle-class wealth in the world’s second biggest economy – dropped at the fastest pace since October 2014, falling 0.7% m/m in May (v/s -0.58% in April) and marking the 11th straight decline despite the government’s stimulus to support the property market. On an annual basis, home prices slumped 4.3%, the biggest drop since the summer of 2015. In fact, the last time home prices plunged so much Beijing pursued a massive yuan devaluation that led to a $1 trillion in fx outflows to stabilize and sparked the very first mega meltup in bitcoin which sent it from $200 to far over $1000.

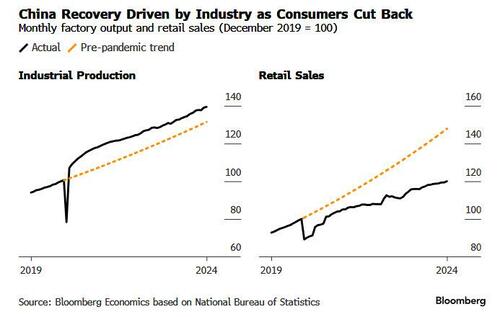

Staying on China retail sales rose +3.7% y/y in May, exceeding market expectations for a +3.0% gain and increasing pace from a +2.3% increase in the previous month but Chinese shoppers remain far from recovering their pre-pandemic mojo. However, other economic metrics failed to surpass market forecasts with industrial output growing +5.6% y/y in May (v/s +6.2% expected), down from an increase of +6.7% in April and missing the median forecast in a Bloomberg survey.

Meanwhile, the nation’s real estate crisis continued to weigh on investment in fixed assets with the overall YTD investment figures expanding +4.0%, also below estimates of +4.2% gain.

“The most disappointing in May’s data is probably that property sales barely saw any improvements even after so many supportive measures,” said Jacqueline Rong, chief China economist at BNP Paribas SA. She said China’s authorities need to find ways to lower the rates on existing mortgages, closing the gap with the cost of new ones.

The numbers – excluding the dire real estate prints – add up to a still-weak recovery most economists said, and will likely require more action from Beijing to bolster consumer demand and tackle imbalances, if this year’s 5% growth target is to be met. That could take the form of stepped-up government spending and heightened efforts by the central bank to put a floor under housing markets and get credit flowing.

On the other hand, if one includes China’s collapsing property market – which once upon a time was the world’s largest asset class – it becomes clear that while Beijing may pretend it does not need a huge fiscal and monetary stimulus, it’s

Late last month, China unveiled a broad rescue package to prop up housing sales as a credit crisis was engulfing some of the country’s biggest real estate developers. It relaxed mortgage rules and encouraged local governments to buy unsold homes. However, as we warned and many others agreed, the financial incentives aren’t big enough and trial programs in several cities have shown progress can be slow.

Subdued demand at home and the deteriorating foreign-trade environment are weighing on business confidence, discouraging companies from investing and driving some to move production overseas. Credit growth has been lackluster and the M1 money supply gauge contracted in May at the fastest rate in data going back to 1996.

Elsewhere, the PBOC on Monday kept a key interest rate unchanged for the tenth straight month. Economists say the bank’s room to cut rates is constrained by the need to prop up the yuan, which faces downward pressure as the US Federal Reserve reinforces its high-for-longer message.

China’s growth remains “highly uneven, with exports and new energy-related capex as the drivers while consumption and property as the drags,” according to economists including Larry Hu at Macquarie Capital Ltd. Still, the slowdown isn’t severe enough to threaten the growth target and while policymakers may take some limited action “the urgency for a major stimulus is low,” they wrote

In a survey of more than 400 top executives conducted by UBS Group AG over roughly a month through mid-May, firms reported weaker prospects for orders, revenue and margins compared with the same period of 2023. There was a drop in the share of respondents who plan to increase capital expenditure in the second half of this year.

“We still need to see new stimulus coming in,” said Helen Qiao, chief Greater China economist at Bank of America Global Research, in a Bloomberg TV interview. “Otherwise the growth momentum could very much weaken.”

Tyler Durden Mon, 06/17/2024 – 18:40

Source: https://freedombunker.com/2024/06/17/chinas-new-home-prices-plunge-the-most-since-october-2014/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Humic & Fulvic Liquid Trace Mineral Complex

HerbAnomic’s Humic and Fulvic Liquid Trace Mineral Complex is a revolutionary New Humic and Fulvic Acid Complex designed to support your body at the cellular level. Our product has been thoroughly tested by an ISO/IEC Certified Lab for toxins and Heavy metals as well as for trace mineral content. We KNOW we have NO lead, arsenic, mercury, aluminum etc. in our Formula. This Humic & Fulvic Liquid Trace Mineral complex has high trace levels of naturally occurring Humic and Fulvic Acids as well as high trace levels of Zinc, Iron, Magnesium, Molybdenum, Potassium and more. There is a wide range of up to 70 trace minerals which occur naturally in our Complex at varying levels. We Choose to list the 8 substances which occur in higher trace levels on our supplement panel. We don’t claim a high number of minerals as other Humic and Fulvic Supplements do and leave you to guess which elements you’ll be getting. Order Your Humic Fulvic for Your Family by Clicking on this Link , or the Banner Below.

Our Formula is an exceptional value compared to other Humic Fulvic Minerals because...

It’s OXYGENATED

It Always Tests at 9.5+ pH

Preservative and Chemical Free

Allergen Free

Comes From a Pure, Unpolluted, Organic Source

Is an Excellent Source for Trace Minerals

Is From Whole, Prehisoric Plant Based Origin Material With Ionic Minerals and Constituents

Highly Conductive/Full of Extra Electrons

Is a Full Spectrum Complex

Our Humic and Fulvic Liquid Trace Mineral Complex has Minerals, Amino Acids, Poly Electrolytes, Phytochemicals, Polyphenols, Bioflavonoids and Trace Vitamins included with the Humic and Fulvic Acid. Our Source material is high in these constituents, where other manufacturers use inferior materials.

Try Our Humic and Fulvic Liquid Trace Mineral Complex today. Order Yours Today by Following This Link.