China To Issue Record 3 Trillion Yuan In Special Treasury Bonds To Boost Economy

It may not be the bazooka, but it’s a start.

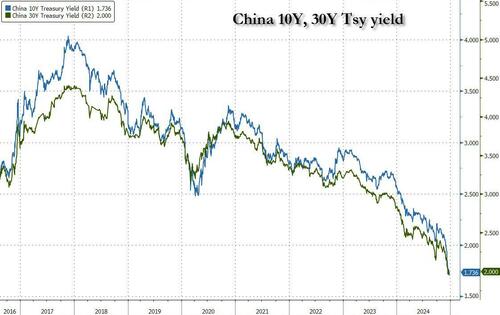

Less than a week after we showed the historic collapse in Chinese interest rates, which sent China’s 1Y yield below 1% for the first time since the Global Financial Crisis, in a move that signaled the bond market is convinced Beijing will unleash the mother of all stimulus…

the last time China 1Y bond traded below 1%, Lehman had just filed for bankruptcy.

Bond market convinced Beijing about to unleash mother of all monetary stimulus and/or QE. Commodities so far unaware. pic.twitter.com/NJnbvdQdoE

— zerohedge (@zerohedge) December 20, 2024

… overnight, Reuters reported that Chinese authorities have agreed to issue 3 trillion yuan ($411 billion) worth of special treasury bonds next year, which would be the highest on record, as Beijing ramps up fiscal stimulus to revive its faltering economy.

The plan for 2025 sovereign debt issuance would be a 200% increase from this year’s 1 trillion yuan and comes as Beijing moves to soften the blow from an expected increase in U.S. tariffs on Chinese imports when Donald Trump takes office in January.

The proceeds will be targeted at boosting consumption via subsidy programs, equipment upgrades by businesses and funding investments in innovation-driven advanced sectors, among other initiatives.

Showing just how much capacity China – which has been gripped in a deflationary vortex for the past year – has for new debt, the country’s 10-year and 30-year treasury yields rose 1 basis point (bp) and 2 bps, respectively, after the news but remained near record lows.

The planned special treasury bond issuance next year would be the largest on record and underscores Beijing’s willingness to go even deeper into debt to counter deflationary forces in the world’s second-largest economy.

The issuance “exceeded market expectations,” said Tommy Xie, head of Asia Macro research at OCBC Bank. “Furthermore, as the central government is the only entity with meaningful capacity for additional leverage, any bond issuance at the central level is perceived as a positive development, likely providing incremental support for growth.”

The “new” initiatives consist of a subsidy program for durable goods, allowing consumers to trade in old cars or appliances and buy new ones at a discount, and a separate one that subsidizes large-scale equipment upgrades for businesses. The “major” programmes refer to projects that implement national strategies such as construction of railways, airports and farmland and build security capacity in key areas, according to official documents.

China does not generally include ultra-long special bonds in annual budget plans, as it sees the instruments as an extraordinary measure to raise proceeds for specific projects or policy goals as needed. As part of next year’s plan, about 1.3 trillion yuan to be raised through long-term special treasury bonds would fund “two major” and “two new” programs.

The state planner NDRC said on Dec. 13 Beijing had fully allocated all proceeds from this year’s 1 trillion yuan in ultra-long special treasury bonds, with about 70% of proceeds financing the “two major” projects and the remainder going towards the “two new” schemes.

Another big portion of the planned proceeds for next year would be for investments in “new productive forces”, Beijing’s shorthand for advanced manufacturing, such as electric vehicles, robotics, semiconductors and green energy. More than 1 trillion yuan would be earmarked for that initiative.

The rest would go to recapitalize large state banks, said the sources, as top lenders struggle with shrinking margins, faltering profits and rising bad loans.

The issuance of new special treasury debt next year would equate to 2.4% of 2023 China’s GDP. By comparison, Beijing raised 1.55 trillion yuan via such bonds in 2007, or 5.7% of economic output at that time.

President Xi Jinping gathered with top officials for the annual Central Economic Work Conference (CEWC) on Dec. 11 and 12 to chart the economic course for 2025. A state media summary of the meeting said it was “necessary to maintain steady economic growth”, raise the fiscal deficit ratio and issue more government debt next year, but did not give specifics.

Last week Reuters reported that China plans to raise the budget deficit to a record 4% of GDP next year and maintain an economic growth target of bout 5%.

At the CEWC, Beijing sets targets for economic growth, the budget deficit, debt issuance and other areas in the year ahead. Though usually agreed by top officials, such targets are not officially unveiled until an annual parliament meet in March and could still change before then.

China’s economy has struggled this year due to a severe property crisis, high local government debt and weak consumer demand. Exports, one of the few bright spots, could soon face U.S. tariffs in excess of 60% if Trump delivers on campaign pledges.

While the risks to exports mean China will need to rely on domestic sources of growth, consumers are feeling less wealthy due to falling property prices and minimal social welfare. Weak household demand also poses a key risk. Last week, officials said Beijing plans to expand the consumer goods and industrial equipment trade-in programs.

Tyler Durden Tue, 12/24/2024 – 12:25

Source: https://freedombunker.com/2024/12/24/china-to-issue-record-3-trillion-yuan-in-special-treasury-bonds-to-boost-economy/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Before It’s News® is a community of individuals who report on what’s going on around them, from all around the world. Anyone can join. Anyone can contribute. Anyone can become informed about their world. "United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

LION'S MANE PRODUCT

Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules

Mushrooms are having a moment. One fabulous fungus in particular, lion’s mane, may help improve memory, depression and anxiety symptoms. They are also an excellent source of nutrients that show promise as a therapy for dementia, and other neurodegenerative diseases. If you’re living with anxiety or depression, you may be curious about all the therapy options out there — including the natural ones.Our Lion’s Mane WHOLE MIND Nootropic Blend has been formulated to utilize the potency of Lion’s mane but also include the benefits of four other Highly Beneficial Mushrooms. Synergistically, they work together to Build your health through improving cognitive function and immunity regardless of your age. Our Nootropic not only improves your Cognitive Function and Activates your Immune System, but it benefits growth of Essential Gut Flora, further enhancing your Vitality.

Our Formula includes: Lion’s Mane Mushrooms which Increase Brain Power through nerve growth, lessen anxiety, reduce depression, and improve concentration. Its an excellent adaptogen, promotes sleep and improves immunity. Shiitake Mushrooms which Fight cancer cells and infectious disease, boost the immune system, promotes brain function, and serves as a source of B vitamins. Maitake Mushrooms which regulate blood sugar levels of diabetics, reduce hypertension and boosts the immune system. Reishi Mushrooms which Fight inflammation, liver disease, fatigue, tumor growth and cancer. They Improve skin disorders and soothes digestive problems, stomach ulcers and leaky gut syndrome. Chaga Mushrooms which have anti-aging effects, boost immune function, improve stamina and athletic performance, even act as a natural aphrodisiac, fighting diabetes and improving liver function. Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules Today. Be 100% Satisfied or Receive a Full Money Back Guarantee. Order Yours Today by Following This Link.