Bond Vigilantes Blow Up German Bond Market After “Whatever It Takes” Fiscal Package

As we detailed earlier, last night saw Germany announce plans for one of its largest fiscal regime shifts in post-war history.

The leaders of CDU/CSU and SPD this evening announced an agreement on an even more significant fiscal expansion than what anyone had expected at the beginning of the week. The plan is to make three material changes to the debt brake in the very near term, convening the outgoing parliament in which the centrist parties still hold a constitutional majority:

- A EUR 500bn (11.6% of GDP in 2024) special purpose off-budget vehicle for infrastructure investment, that is planned to be disbursed over the next 10 years, and which amounts to roughly 1% of GDP in annual infrastructure spending (of which EUR 100bn will be allocated to the federal states).

- A reform of the debt brake to exempt any defense spending in the main budget’s “Einzelplan 14″, the budget of the Ministry of Defence, over and above 1% of GDP, effectively permitting open-ended borrowing for defense. Currently the Einzelplan 14 amounts to EUR 53.25bn (1.25% of nominal GDP in 2024). The current off-budget fund adds another EUR 25bn of defence funding but this would not be relevant for this part of the proposal. Thus apart from removing any constitutional limit on additional defence spending, 0.25% of GDP (EUR 11bn) of spending in Einzelplan 14 that surpasses the 1% threshold is freed up to fund other measures, for example tax reductions.

- An increase in the structural deficit allowed for the states (Länder) from the current level of 0.0% of GDP to 0.35%, the same proportion as the federal level. Furthermore the proposal includes the formation of an expert commission tasked with creating a long-term reform proposal to structurally reform the debt brake by the end of 2025. This would have to be passed by the newly elected 21st Bundestag. It remains unclear if this reform proposal would supersede the announced measures to be passed in the 20th Bundestag or would add to them.

All elements require a two-thirds constitutional supermajority. The parties want to pass the agreed measures with the old 20th Bundestag parliament, before the newly elected 21st Bundestag (where the AfD has a potential blocking minority) is convened on March 25.

In keeping with recycled European aphorisms, party leaders, especially the Conservatives, explicitly referred to this decision as a “whatever it takes” moment and a determination to “rearm completely”. According to DB’s reading, tonight’s robust rhetoric implies that the open-ended borrowing room for defense will be used at a pace that could bring German defence spending to at least 3% perhaps as early as next year (although the exact target may only be defined after the NATO summit in June).

Assuming it goes through, Deutsche Bank’s Jim Reid warns that everything you thought you knew about Germany’s economic prospects 3 months ago, or even 3 weeks ago, should be ripped up and you should start your analysis from fresh.

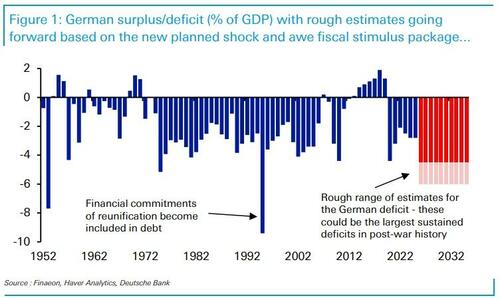

Today’s CoTD simply looks at Germany’s fiscal deficit through time and assumes an extra 3% deficit phased in over the next decade from current levels.

This is incredibly back of the envelope, but puts the planned move in some historical perspective.

Of course, if growth rebounds then this may reduce the deficit so there are a lot of moving parts. However, this could easily be a sustained fiscal stimulus unparalleled in Germany’s history. Germany will still likely have the lowest debt/GDP in the G7 as far as the eye can see.

We estimated that Germany could spend around $1.6tn before its debt/GDP equalled the second lowest (the US) in the G7.

This package has the potential to be in the magnitude of around $1tn over time and the US won’t stand still in terms of its debt over this period.

If you want a bit of fun, Germany could spend $8.5tn before its debt/GDP equalled Japan’s!

So don’t underestimate how important this news is. Your portfolio over time will thank you for it.

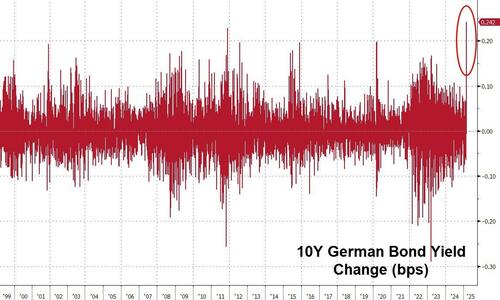

Indeed it will, if you were long bunds as zee bond vigilantes just sent Bund yields higher by over 24bps…

…the biggest yield jump in history for the German bond market…

The FT reports that investors said the bond sell-off did not reflect concerns about the sustainability of Berlin’s debt, which at around 63 per cent of GDP is far lower than the level in other big western economies such as France, the UK and the US.

In contrast with recent rises in borrowing costs in countries such as the UK, which have threatened their fiscal plans, markets were pricing in a better growth trajectory that was boosting risky assets such as stocks at the expense of ultra-safe government debt.

“Yields are rising because of the perception that Germany is turning on the growth tap. It is very risk-positive,” said Karen Ward, a strategist at JPMorgan Asset Management.

We are not sure we’re buying what these analysts are selling on this one – especially as we noted overnight that swap spreads are literally exploding.

And remember, Europe is well-known for suffering sovereign debt crises at the worst possible time, and should inflation remain stubbornly sticky, the yield on new German debt may soon become unmanageable… which means the ECB will have to step in and monetize German deficit spending, as it did for much of the past decade. The only problem: it will first need a market and/or deflationary shock to greenlight such an intervention. Although in light of events in the past 5 years, we doubt very much that the Frankfurt-based central bank will have any problems coming up with yet another fake crisis to capitalize on.

This sudden (and urgent) surge in borrowing comes after Zelensky publicly snubbed Trump’s deal in The Oval Office – prompting VP Vance to explain that this was a done deal… “someone got to him… likely it was our European allies”…

Yes! Lost in the temper tantrum thrown by pissy pants Zelensky is that this was a DONE DEAL. The signing was pro forma. Someone got to him. Likely it was our “European allies.”

— Cernovich (@Cernovich) March 4, 2025

Are we giving zee Germans too much credit for a 4D-Chess move? Did our “allies” force Zelensky to tank the deal with Trump at the last minute, to prompt a new ‘crisis’ (it worked with COVID, remember), enabling them to bypass the debt brake in the name of security, freedom, and whatever patriotic, democracy-saving narrative they choose next? Perhaps, but if the shoe fits (mixing analogies unapologetically) as the deadline for government change in Germany (March 24th) looms and the AfD’s ability block this massive debt plan looms even larger indeed.

Tyler Durden Wed, 03/05/2025 – 08:15

Source: https://freedombunker.com/2025/03/05/bond-vigilantes-blow-up-german-bond-market-after-whatever-it-takes-fiscal-package/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Before It’s News® is a community of individuals who report on what’s going on around them, from all around the world. Anyone can join. Anyone can contribute. Anyone can become informed about their world. "United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

LION'S MANE PRODUCT

Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules

Mushrooms are having a moment. One fabulous fungus in particular, lion’s mane, may help improve memory, depression and anxiety symptoms. They are also an excellent source of nutrients that show promise as a therapy for dementia, and other neurodegenerative diseases. If you’re living with anxiety or depression, you may be curious about all the therapy options out there — including the natural ones.Our Lion’s Mane WHOLE MIND Nootropic Blend has been formulated to utilize the potency of Lion’s mane but also include the benefits of four other Highly Beneficial Mushrooms. Synergistically, they work together to Build your health through improving cognitive function and immunity regardless of your age. Our Nootropic not only improves your Cognitive Function and Activates your Immune System, but it benefits growth of Essential Gut Flora, further enhancing your Vitality.

Our Formula includes: Lion’s Mane Mushrooms which Increase Brain Power through nerve growth, lessen anxiety, reduce depression, and improve concentration. Its an excellent adaptogen, promotes sleep and improves immunity. Shiitake Mushrooms which Fight cancer cells and infectious disease, boost the immune system, promotes brain function, and serves as a source of B vitamins. Maitake Mushrooms which regulate blood sugar levels of diabetics, reduce hypertension and boosts the immune system. Reishi Mushrooms which Fight inflammation, liver disease, fatigue, tumor growth and cancer. They Improve skin disorders and soothes digestive problems, stomach ulcers and leaky gut syndrome. Chaga Mushrooms which have anti-aging effects, boost immune function, improve stamina and athletic performance, even act as a natural aphrodisiac, fighting diabetes and improving liver function. Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules Today. Be 100% Satisfied or Receive a Full Money Back Guarantee. Order Yours Today by Following This Link.