Liquidity Floodgates Open As 3 Central Banks Unexpectedly Cut Rates In Under 24 Hours

Trump has repeatedly expressed his displeasure with the ECB cutting rates 8 times since the end of the central bank’s hiking cycle one year ago; he certainly won’t be happy that three other European central banks joined the easing fray overnight as the global economy once again careens toward the abyss.

In the span of less than 24 hours, three rate cuts by three central banks in Europe underscored the dramatic global shift toward policy easing as monetary officials seek to manage “the fallout from Trump’s unpredictable trade policies” as Bloomberg puts it, but really that’s just a diversion for the real cause: global economic slowdown now that the last traces of stimulus from the post-covid monetary and fiscal bonanza fade away.

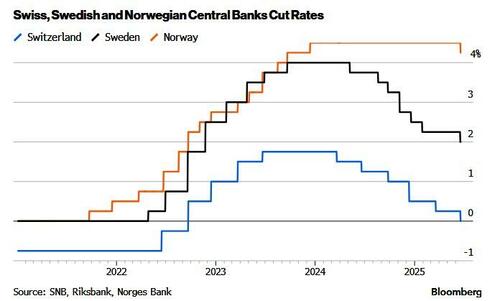

Central bankers in Switzerland and Sweden had suggested as recently as March that they were likely done easing, but the Swiss National Bank instead trimmed borrowing costs by 25 basis points on Thursday – and becoming the first major bank to cut rates back to zero (and in some cases, negative) – following a similar move by Sweden’s Riksbank a day earlier. And an easing pivot by Norway, also on Thursday, was altogether more dramatic, with another quarter-point cut that none of the economists surveyed by Bloomberg predicted.

With policy decisions from at least 18 central banks managing more than 40% of the global economy scheduled for this week, the easing across much of Europe contrasted with a wait-and-see approach predominating around the world. Also on Thursday, the Bank of England held rates but the much more dovish than expected decision (6-3 voted to keep rates unchanged, while expectations were for a 7-2 split) sent the pound sliding.

Meanwhile, the Federal Reserve, and Bank of Japan both held, the first however because it has a political vendetta against Trump…

The day is August 27, 2019. Former NY Fed president Bill Dudley writes a Bloomberg oped saying “the Fed shouldn’t enable Donald Trump” and urged the central bank not to “provide offsetting stimulus” in Trump’s trade war with China.

Six years later, here we are pic.twitter.com/H6WT5O0cMD

— zerohedge (@zerohedge) April 11, 2025

… and the second because it has no idea how to grow rice anymore and the local population has been crushed by surging food prices which somehow a stronger yen is expected to make better.

All that comes against the backdrop of a July 9 deadline that could see the US reintroduce punitive trade tariffs across the world. Combined with continued uncertainty over the war in Ukraine and a potential US strike on Iran, it’s left some policymakers unwilling or unable to move.

Meanwhile, the reasons for the rate cuts in Sweden, Norway and Switzerland are all linked to inflation, even if the situations diverge.

Swiss consumer prices fell 0.1% from a year ago in May and new SNB forecasts published Thursday show inflation will average just 0.2% this year. That’s primarily due to the haven franc, which has appreciated against the dollar and euro since Trump took office.

Price pressure in Sweden, whose currency has soared against the dollar in 2025, has eased after a temporary spike at the start of the year and as a nascent rebound in the largest Nordic nation has fizzled out. That’s allowing space for more stimulus, Riksbank Governor Erik Thedeen said Wednesday.

The krona has been the best performer this year in the G-10 of major currency holders, surging 15% against the dollar, and also helping to reduce the risk of imported inflation.

In Norway, price growth has been stickier over the last year, partly due to a weaker performance of the krone. Even so, the local core CPI last month matched this year’s lowest level, at 2.8%. The Norwegian central bank now sees headline price growth next year at 2.2%, down from 2.7% seen in March, while this year’s inflation is still seen at 3%.

The three institutions are also at very different stages in their policy paths: Norway’s Thursday move is its first post-pandemic reduction in borrowing costs, while Sweden and Switzerland carried out their seventh and six moves respectively.

Uniting them, however, is the fact that they all may cut again. Riksbank’s Thedeen and Norges Bank Governor Ida Wolden Bache both told reporters as much, while SNB President Martin Schlegel wouldn’t exclude such an option, even if that would push the Swiss rate into negative territory.

Which again begs the question: just how deflationary are tariffs anyway?

Tyler Durden Thu, 06/19/2025 – 22:25

Source: https://freedombunker.com/2025/06/19/liquidity-floodgates-open-as-3-central-banks-unexpectedly-cut-rates-in-under-24-hours/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Before It’s News® is a community of individuals who report on what’s going on around them, from all around the world. Anyone can join. Anyone can contribute. Anyone can become informed about their world. "United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

LION'S MANE PRODUCT

Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules

Mushrooms are having a moment. One fabulous fungus in particular, lion’s mane, may help improve memory, depression and anxiety symptoms. They are also an excellent source of nutrients that show promise as a therapy for dementia, and other neurodegenerative diseases. If you’re living with anxiety or depression, you may be curious about all the therapy options out there — including the natural ones.Our Lion’s Mane WHOLE MIND Nootropic Blend has been formulated to utilize the potency of Lion’s mane but also include the benefits of four other Highly Beneficial Mushrooms. Synergistically, they work together to Build your health through improving cognitive function and immunity regardless of your age. Our Nootropic not only improves your Cognitive Function and Activates your Immune System, but it benefits growth of Essential Gut Flora, further enhancing your Vitality.

Our Formula includes: Lion’s Mane Mushrooms which Increase Brain Power through nerve growth, lessen anxiety, reduce depression, and improve concentration. Its an excellent adaptogen, promotes sleep and improves immunity. Shiitake Mushrooms which Fight cancer cells and infectious disease, boost the immune system, promotes brain function, and serves as a source of B vitamins. Maitake Mushrooms which regulate blood sugar levels of diabetics, reduce hypertension and boosts the immune system. Reishi Mushrooms which Fight inflammation, liver disease, fatigue, tumor growth and cancer. They Improve skin disorders and soothes digestive problems, stomach ulcers and leaky gut syndrome. Chaga Mushrooms which have anti-aging effects, boost immune function, improve stamina and athletic performance, even act as a natural aphrodisiac, fighting diabetes and improving liver function. Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules Today. Be 100% Satisfied or Receive a Full Money Back Guarantee. Order Yours Today by Following This Link.