How not to protect American industry. Be bipolar.

Here is the situation: Chinese manufacturers, possibly with the financial aid of the Chinese government, are taking business from key American industries.

Quality and other marketing factors are not the real issues. The Chinese companies are doing this with low prices.

How should the American government protect these important industries?

The American government essentially has two alternatives:

- It can force American consumers and businesses to pay higher prices for Chinese goods while taking growth dollars out of the U.S. economy, or

- It can help American consumers and businesses to pay lower prices for American goods while adding growth dollars to the U.S. economy.

Which alternative is better for American consumers and businesses?

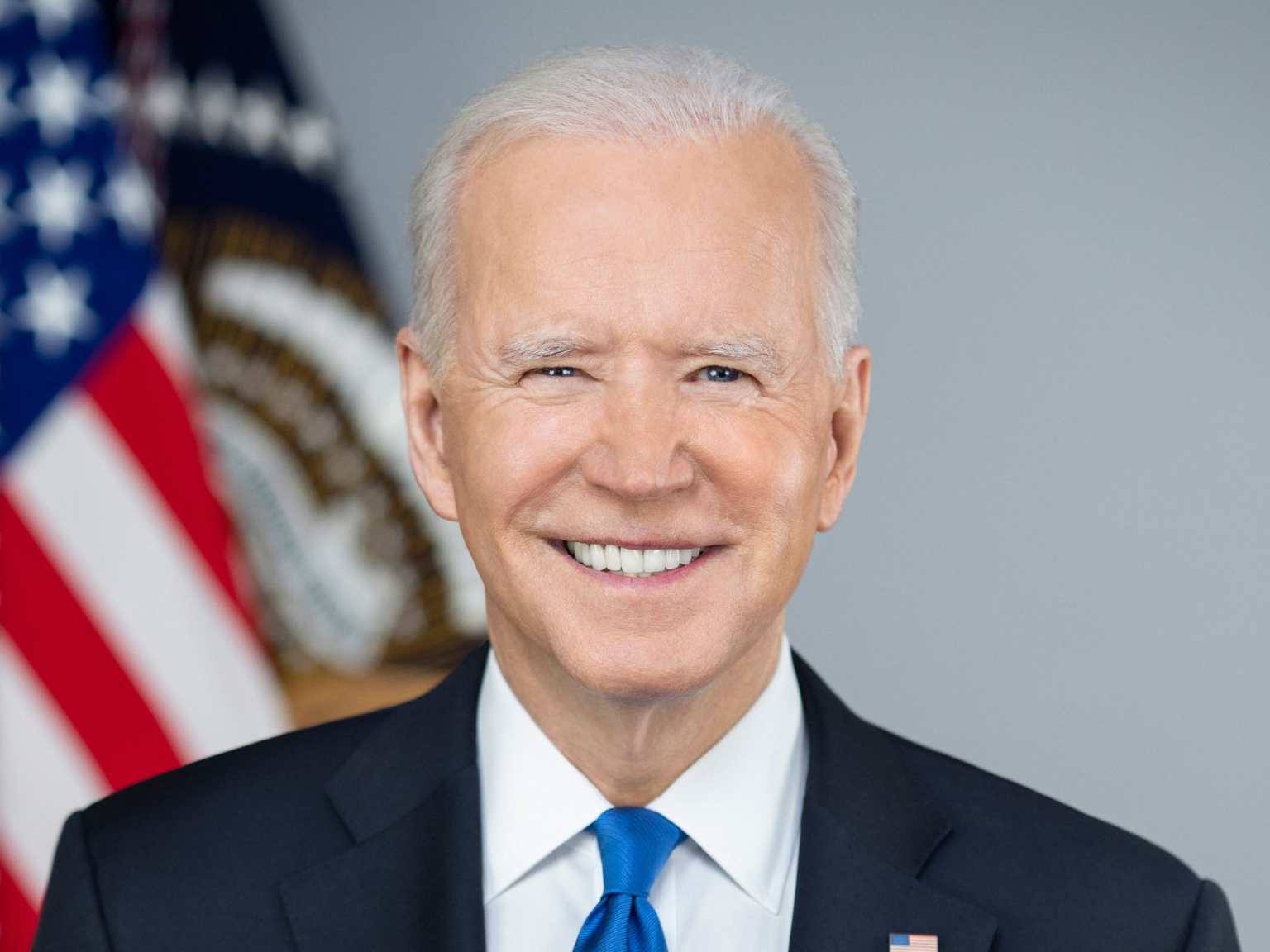

The Biden administration, and the Trump administration before it, have chosen alternative #1: Higher prices for Chinese goods and reducing Gross Domestic Product by taking dollars out of the economy.

For reasons beyond logic and common sense, both administrations believe American consumers and businesses should pay higher prices for important commodities, and somehow this not only is beneficial but won’t be inflationary.

So they add high taxes, which Americans pay, to the prices of Chinese goods.

The alternative, of course, is to give American manufacturers tax breaks or other financial support, so they can compete on prices.

That, in fact, is the primary purpose of federal taxes: To control the economy by giving tax breaks to what the government wishes to encourage.

Increasing federal taxes should only be a last resort, a punishment when a reward doesn’t work.

Federal taxes do not fund federal spending. They are a tool for federal economic control.

But rather than use that tool, the federal government has chosen to punish American consumers with higher prices.

Biden announces new tariffs on imports of Chinese goods, including electric vehicles

MAY 14, 20245:01 AM ET

Asma KhalidPresident Biden will slap tariffs on $18 billion of imports of goods from China including electric vehicles, semiconductors, and medical products to protect the strategic sectors and punish China for unfair trade practices.

He could have given tax breaks and other financial support to America’s manufacturers of electric vehicles, semiconductors, and medical practices, thereby saving American consumers money and fighting inflation.

He will also keep in place the tariffs that former President Donald Trump had placed on more than $300 billion of imports from China.

He correctly criticized Trump for the tariffs that are paid for by American consumers.

Treasury Secretary Janet Yellen said in a statement that she raised concerns last month during a trip to Beijing about “artificially cheap Chinese imports,” concerns that she said many other countries share.

She said the new tariffs are necessary to protect American workers and companies from what could become a flood of unfairly traded products.

This “protects American workers and companies” by making them pay more for the products. Some protection that is.

The move comes as Biden pushes forward to implement three pieces of legislation that contain hundreds of billions of subsidies to boost the domestic manufacturing and clean energy sectors— and ahead of a presidential election where trade and jobs will again be an issue.

The Biden administration suffers from bipolar disease. On the one hand, they subsidize industries, and on the other hand, they charge them more in taxes.

“We know China’s unfair practices have harmed communities in Michigan and Pennsylvania and around the country that are now having the opportunity to come back due to President Biden’s investment agenda,” Lael Brainard, Biden’s top economic adviser, told reporters.

His investment agenda is good, but it’s being undone by his import duty agenda.

Additionally, duties take dollars out of the economy, which by formula, reduces Gross Domestic Product. This is a recessionary act.

If instead, the Biden administration stuck with subsidies, this would add dollars to the economy, a growth act.

Between growth and recession, Biden chose recession.

Here’s a list of the new tariffs. Most of the new tariffs cover items that the Biden administration has sought to have made in America through investments in the Inflation Reduction Act, the CHIPS and Science Act and the Bipartisan Infrastructure Law.

Some increases will take place this year. They include tariffs of:

100% on electric vehicles, up from 25%

50% on solar cells, up from 25%

50% on syringes and needles, up from zero

25% on lithium-ion batteries for electric vehicles, and battery parts, up from 7.5%

25% on certain critical minerals, up from zero

25% on steel and aluminum products, up from a range of zero to 7.5%

25% on respirators and face masks, up from zero to 7.5%

25% on cranes used to unload container ships, up from 0%

China makes cheap electric vehicles. Why can’t American shoppers buy them?Other hikes will be phased in, including:

50% on semiconductors, up from 25%, by 2025

25% on other lithium-ion batteries, by 2026

25% on natural graphite and permanent magnets, up from zero, by 2026

25% on rubber medical and surgical gloves, up from 7.5%, by 2026The White House says this is different from Trump’s approach.

No, it isn’t different. Give it any name you can invent and it still is a tax on purchases. It still takes dollars out of the economy. It still punishes consumers. It still is inflationary and recessionary.

Trump had made tariffs on China one of his signature policy moves when he was in the White House. At first, some Democrats warned this could really hurt the economy — and that American consumers would pay the price.

Biden’s team began reviewing those tariffs when he took office, and now has decided to keep them in place.

“One of the challenges is once tariffs have been imposed, it is quite difficult politically to reduce them — because the affected industry tends to get used to them, like them, operate with them as baked into their plans,” said Michael Froman, who was U.S. Trade Representative during the Obama administration.

It would be far more beneficial to the economy and consumers for industries to “get used to” subsidies, which grow the economy than to get used to taxes, which are inflationary and recessionary.

The White House has tried to distinguish its strategy from Trump’s approach.

It points to comments made by Trump in rallies and interviews that he would broaden tariffs on all imported goods, including targeting Chinese cars, if he wins the election — something that they said would hike consumer prices.

Huh? Taxes on Chinese cars would hike consumer prices, but taxes on the above-listed items will not hike consumer prices???

The White House has downplayed the risk that the new tariffs could spark retaliation from China, saying that the issues have been discussed during meetings of top U.S. and Chinese officials, and were unlikely to come as a surprise.

One could only hope that the Chinese government is as foolish as the American government, and increase tariffs on imports of American goods. That would be a blow to the Chinese economy.

SUMMARY

Raising federal taxes on the American consumer takes dollars out of the American economy, raises prices, and costs consumers money. It is the worst possible step the government could take.

To protect American businesses, the government should rely on tax breaks and other forms of financial support, which would add growth dollars to the economy and lower inflationary prices.

Rodger Malcolm Mitchell

Monetary Sovereignty

Twitter: @rodgermitchell Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

……………………………………………………………………..

The Sole Purpose of Government Is to Improve and Protect the Lives of the People.

MONETARY SOVEREIGNTY

Source: https://mythfighter.com/2024/05/14/how-not-to-protect-american-industry-be-bipolar/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Humic & Fulvic Liquid Trace Mineral Complex

HerbAnomic’s Humic and Fulvic Liquid Trace Mineral Complex is a revolutionary New Humic and Fulvic Acid Complex designed to support your body at the cellular level. Our product has been thoroughly tested by an ISO/IEC Certified Lab for toxins and Heavy metals as well as for trace mineral content. We KNOW we have NO lead, arsenic, mercury, aluminum etc. in our Formula. This Humic & Fulvic Liquid Trace Mineral complex has high trace levels of naturally occurring Humic and Fulvic Acids as well as high trace levels of Zinc, Iron, Magnesium, Molybdenum, Potassium and more. There is a wide range of up to 70 trace minerals which occur naturally in our Complex at varying levels. We Choose to list the 8 substances which occur in higher trace levels on our supplement panel. We don’t claim a high number of minerals as other Humic and Fulvic Supplements do and leave you to guess which elements you’ll be getting. Order Your Humic Fulvic for Your Family by Clicking on this Link , or the Banner Below.

Our Formula is an exceptional value compared to other Humic Fulvic Minerals because...

It’s OXYGENATED

It Always Tests at 9.5+ pH

Preservative and Chemical Free

Allergen Free

Comes From a Pure, Unpolluted, Organic Source

Is an Excellent Source for Trace Minerals

Is From Whole, Prehisoric Plant Based Origin Material With Ionic Minerals and Constituents

Highly Conductive/Full of Extra Electrons

Is a Full Spectrum Complex

Our Humic and Fulvic Liquid Trace Mineral Complex has Minerals, Amino Acids, Poly Electrolytes, Phytochemicals, Polyphenols, Bioflavonoids and Trace Vitamins included with the Humic and Fulvic Acid. Our Source material is high in these constituents, where other manufacturers use inferior materials.

Try Our Humic and Fulvic Liquid Trace Mineral Complex today. Order Yours Today by Following This Link.