Three Choices, None Good

The moral rot of unlimited debt looks “free” but it’s unaffordable in the end.

We like to think we’re special and this moment in history is special, but alas, we’re still running Wetware 1.0 which was coded between 300,000 and 60,000 years ago, when the last “out of Africa” migration finally got traction. Since then, the code has been tweaked a bit here and there (adults can now digest dairy products, etc.), but we’re running the old code, and so we make the same mistakes and follow the same emotional pathways as individuals and as groups.

Which leads us to our current predicament, which is not unique: we’re living on debt, “money” borrowed from the future, a future we’re assuming will be so over-supplied with energy and other goodies that we’ll be able to pay all the interest we’re piling up with ease.

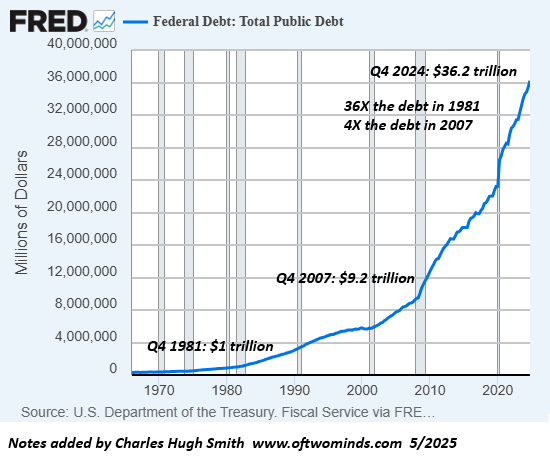

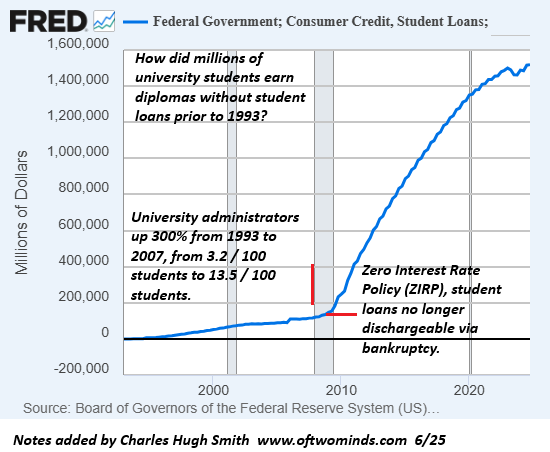

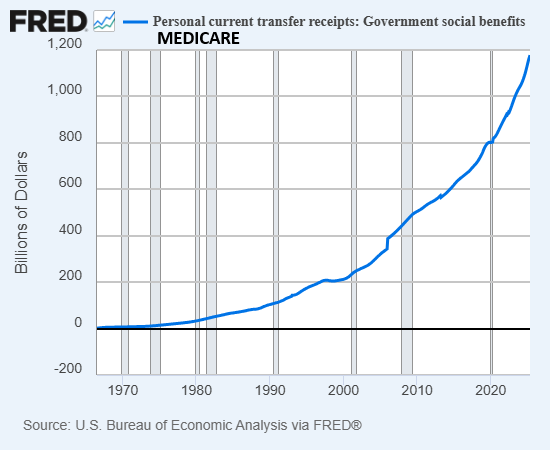

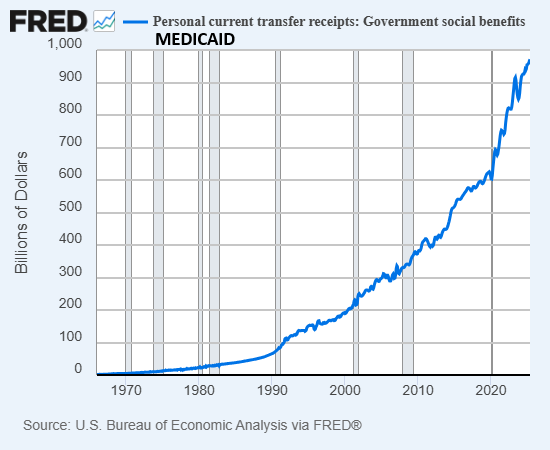

All the charts below are shouting “parabolic,” as in crazy-unsustainable increases. There’s the federal debt, $36 trillion, up 4X from the 2008 spot of bother, there’s TCMDO, total public and private debt (McMansions, university degrees and SUVs all paid for with debt), student loans from zero to $1.5 trillion, Medicare and Medicaid, now 1/3 of the federal budget, and so on.

How did we get here? Let’s start with what’s not taught in Econ 101: primary surplus. Every economy–from households to empires, meaning this is scale-invariant–generates a surplus from its production of goods and services, or it runs a deficit, meaning it has to get more money from somewhere to support its consumption.

The question then becomes, how is the primary surplus being spent? (Or put another way, how is it being distributed across the economy and society?) There are only three options: 1) consume it, 2) invest it and 3) save it / hoard it.

Without making a conscious choice, the US has chosen to “invest” most of its primary surplus in moral rot, unproductive frauds, skims, scams, monopolies, cartels, regulatory capture, grift and graft.

This is the problem with giving an irresponsible teenager a no-limit Platinum credit card with an easily ignored admonishment to “stick to a tight budget, pay the balance off every month.” Uh, right.

Since the US can borrow unlimited trillions on its credit card, we can “afford” to burn our surplus on grift, graft, inefficiency, cronyism, profiteering, etc. Since our surplus was squandered on moral rot, we have to borrow trillions to pay for what the citizenry wants and what politicians must promise to get re-elected.

Wetware 1.0: we like windfalls and free stuff, and so every program becomes a “third rail” politically: touch it and you don’t get re-elected. But if you borrow a few “free” trillions a year, you get re-elected.

We love windfalls and free stuff and hate hard choices, but that’s all we have now. We have three choices in how we deal with our dependence on parabolic debt to sustain our profligate lifestyle:

1. Run the debt up to the point that nobody is dumb enough to lend us more, and then default on the debt / go bankrupt. All our creditors are wiped out.

The problem here is all debt is an asset to the wealthy entity that owns it as an income stream. Since the wealthy run the status quo in a manner that serves their interests, they’re unlikely to be thrilled with debt jubilees that zero out their assets and income or messy defaults that end up doing the same thing.

So nix that option. The wealthy want to keep their wealth and income streams, and since they own US Treasuries, they’re not going to approve defaulting on that debt.

2. Inflate the debt away with sustained high inflation. So we borrowed $1 when $1 bought a lot of stuff, and now we’ve inflated everything so it takes $10 to buy what $1 bought back then. Now we can pay back the $1 with a fraction of the earnings it took back when we borrowed it.

We’ve already taken that step–what once cost $1 now costs $10. So the next step is to do another 10X reduction in the debt via inflation.

In previous eras, authorities reduced the silver content of coinage to near-zero, effectively devaluing the money, i.e. inflating away the debt. What cost one mostly-silver denarius in the good old days soon cost 100 devalued denarius.

This looks like some pretty easy hocus-pocus to pull off, but there’s a catch: Catch-19, which is devaluing the money devalues trust in the leadership, social contract and the future, all of which leaves the economy and society a hollowed-out shell awaiting a stiff breeze to push the whole system off the cliff.

The problem here is inflation is distributed asymmetrically, along with the primary surplus. The wealthy, powerful elites skim off the surplus, and they’re equally adept at distributing the “inflation tax” to the middle and working classes, which soon meld into a single class, the impoverished.

A funny thing about Wetware 1.0 is we’re hard-wired to take note of rampant unfairness and eventually we respond in a destabilizing fashion, for example, uprisings, revolts, revolutions, etc.

3. The third option is to root out all the moral rot that’s consuming the economy’s surplus and our future, scrap all the programs designed in the bygone eras of 50+ years ago (defense, Social Security, Medicare, Medicaid, higher education, etc.) and start from scratch with new programs whose expenses are limited to what the economy generates as surplus.

In other words, go Cold Turkey on our addiction to living on debt.

Yes, I know: ain’t gonna happen, because the moral rot is too deep, it’s now normalized to the point that we don’t even recognize the reality that there’s nothing left but a flimsy facade we paint with gaudy colors to hide the rot.

Everyone assumes the empire is forever and can endlessly fund any amount of grift and graft with borrowed money. But this is a self-serving fantasy, not reality. Every empire of debt implodes.

These charts are merely facts. If we find them depressing, that response says something about our refusal to be accountable and responsible for our choices. Who’s going to cut up the unlimited Platinum card?

The federal government’s Platinum card balance:

The US economy’s Platinum card balance:

Student loans Platinum card balance:

Medicare, which has an unlimited Platinum card:

Medicaid, which also has an unlimited Platinum card, though this is obscured by phony “reforms”:

There are only three options, none easy, and not making a choice is a greased slide to collapse. The moral rot of unlimited debt looks “free” but it’s unaffordable in the end.

Check out my new book Ultra-Processed Life and my new fiction/novels page.

Become a $3/month patron of my work via patreon.com.

Subscribe to my Substack for free

My recent books:

Disclosure: As an Amazon Associate I earn from qualifying purchases originated via links to Amazon products on this site.

Ultra-Processed Life print $16, (Kindle $7.95, Hardcover $20 (129 pages, 2025) Read the Introduction and first chapter for free (PDF)

The Mythology of Progress, Anti-Progress and a Mythology for the 21st Century print $16, (Kindle $6.95, Hardcover $24 (215 pages, 2024) Read the Introduction and first chapter for free (PDF)

Self-Reliance in the 21st Century print $15, (Kindle $6.95, audiobook $13.08 (96 pages, 2022) Read the first chapter for free (PDF)

When You Can’t Go On: Burnout, Reckoning and Renewal $15 print, $6.95 Kindle ebook; audiobook Read the first section for free (PDF)

Global Crisis, National Renewal: A (Revolutionary) Grand Strategy for the United States (Kindle $6.95, print $16, audiobook) Read Chapter One for free (PDF).

A Hacker’s Teleology: Sharing the Wealth of Our Shrinking Planet (Kindle $6.95, print $15, audiobook $17.46) Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World

(Kindle $3.95, print $12, audiobook) Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake (Novel) $3.95 Kindle, $12 print); read the first chapters for free (PDF)

Money and Work Unchained $6.95 Kindle, $15 print) Read the first section for free

Become a $3/month patron of my work via patreon.com.

Subscribe to my Substack for free

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

|

Thank you, Lance H. ($70), for your exceedingly generous subscription to this site — I am greatly honored by your support and readership. |

Thank you, Marko ($70), for your marvelously generous subscription to this site — I am greatly honored by your support and readership. |

|

|

Thank you, Jim T. ($70), for your superbly generous subscription to this site — I am greatly honored by your support and readership. |

Thank you, Jay ($32), for your splendidly generous subscription to this site — I am greatly honored by your support and readership. |

Source: http://charleshughsmith.blogspot.com/2025/07/three-choices-none-good.html

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Before It’s News® is a community of individuals who report on what’s going on around them, from all around the world. Anyone can join. Anyone can contribute. Anyone can become informed about their world. "United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

LION'S MANE PRODUCT

Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules

Mushrooms are having a moment. One fabulous fungus in particular, lion’s mane, may help improve memory, depression and anxiety symptoms. They are also an excellent source of nutrients that show promise as a therapy for dementia, and other neurodegenerative diseases. If you’re living with anxiety or depression, you may be curious about all the therapy options out there — including the natural ones.Our Lion’s Mane WHOLE MIND Nootropic Blend has been formulated to utilize the potency of Lion’s mane but also include the benefits of four other Highly Beneficial Mushrooms. Synergistically, they work together to Build your health through improving cognitive function and immunity regardless of your age. Our Nootropic not only improves your Cognitive Function and Activates your Immune System, but it benefits growth of Essential Gut Flora, further enhancing your Vitality.

Our Formula includes: Lion’s Mane Mushrooms which Increase Brain Power through nerve growth, lessen anxiety, reduce depression, and improve concentration. Its an excellent adaptogen, promotes sleep and improves immunity. Shiitake Mushrooms which Fight cancer cells and infectious disease, boost the immune system, promotes brain function, and serves as a source of B vitamins. Maitake Mushrooms which regulate blood sugar levels of diabetics, reduce hypertension and boosts the immune system. Reishi Mushrooms which Fight inflammation, liver disease, fatigue, tumor growth and cancer. They Improve skin disorders and soothes digestive problems, stomach ulcers and leaky gut syndrome. Chaga Mushrooms which have anti-aging effects, boost immune function, improve stamina and athletic performance, even act as a natural aphrodisiac, fighting diabetes and improving liver function. Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules Today. Be 100% Satisfied or Receive a Full Money Back Guarantee. Order Yours Today by Following This Link.