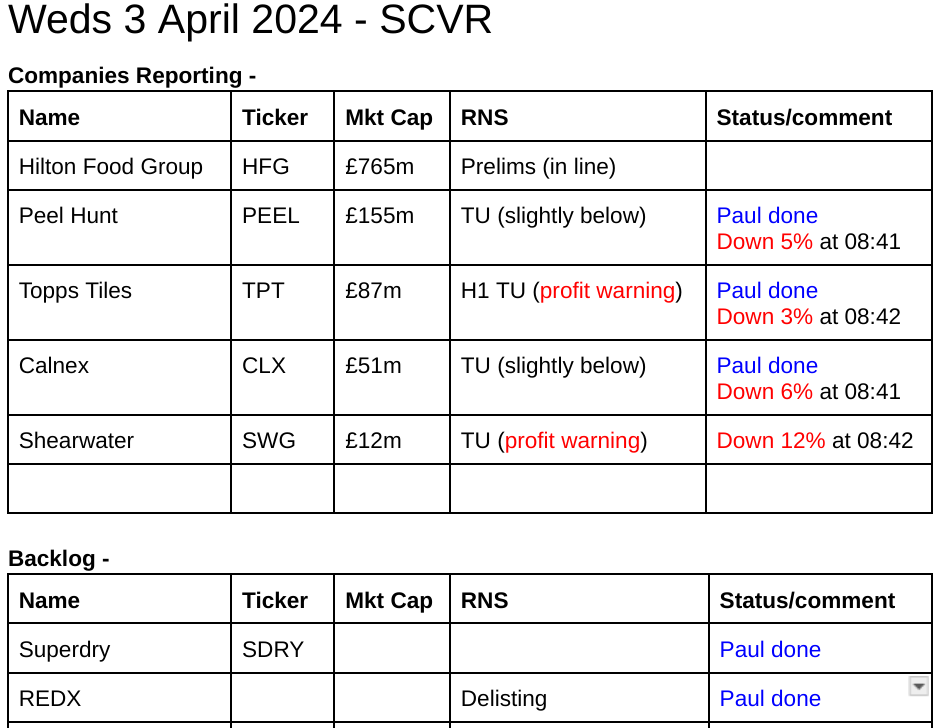

Small Cap Value Report (Weds 3 April 2024) - SDRY, REDX, TPT, PEEL, CLX

Good morning from Paul amp; Graham!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates amp; results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it’s anybody’s guess what direction market sentiment will take amp; nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed – please be civil, rational, and include the company name/ticker, otherwise people won’t necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we’re not making any predictions about what share prices will do.

Green (thumbs up) – means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it’s such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber – means we don’t have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) – means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we’re not saying the share price will necessarily under-perform, we’re just flagging the high risk.

Links:

Paul amp; Graham’s 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul’s podcasts (weekly summary of SCVRs amp; macro views) – or search on any podcast provider for “Paul Scott small caps” – eg Apple, Spotify.

Summaries of main sections

Paul’s section: Superdry (LON:SDRY)

Down 53% y’day to 13p (£13m) – Dunkerton not bidding – Paul – RED

As regulars here will know, we’ve been very negative about SDRY’s chances of a turnaround or indeed survival, for a long time (I gave up counting after reading the last 9 reviews of it here, all negative).

As mentioned in Thursday’s SCVR, the bombshell announcement came from founder/CEO Julian Dunkerton, saying he did not intend bidding for the company. Far worse though, it also included this bit -

… is in discussions with the Company in respect of alternative structures, including a possible equity raise fully underwritten by Julian Dunkerton, which would provide additional liquidity headroom for the Company’s turnaround plan. It is expected that any equity raise would be at a very material discount to the current share price, require shareholder approval of a Rule 9 waiver (as referred in Note 1 of the Notes on Dispensations from Rule 9 of the Code) and be conditional on a de-listing of the Company. A further announcement will be made as appropriate. There can be no certainty that a transaction with Julian Dunkerton will be agreed.

So there you have it – a deeply discounted fundraise, conditional on a delisting. That makes SDRY shares uninvestable for many investors, who can’t or don’t want to own shares in a private company.

It’s really now a question of how long SDRY can limp on for? Suppliers can see the share price, and read the news, so why would anyone now send any more deliveries into SDRY, knowing that as an unsecured creditor they’ll get nothing once it goes into administration? I can’t see trade credit insurers touching it now either. So I imagine insolvency could be quite rapid now, but it doesn’t really matter, as existing equity is likely to be wiped out in an emergency fundraise even if they manage to keep trading.

The key thing with situations like this, is not to throw good money after bad by averaging down on a situation that has gone disastrously wrong, in the forlorn hope of recovering previous losses. I hope nobody here got caught on this one, if so – why, when the risk was so obvious???!

Redx Pharma (LON:REDX)

Down 66% to 6.5p y’day (£25m) – Proposed Delisting – Paul – GREY (delisting flag)

We’ve not written about this share here since 2017, as the numbers were always so bad they didn’t justify any mentions.

The announcement yesterday from REDX saying it intends delisting, follows the usual format – telling us that the company has a great track record (despite making massive losses every year), and that AIM is of no use to them as they cant tap anyone for any more cash to burn.

The funding mugs are now employed in private finance markets -

The Board believes that as a private company we can access a broader universe of specialty investors and, accordingly, a larger quantum of future funding required to execute our strategy and maximise our value in the interests of all our Shareholders.

Paul’s view – AIM has never been the right place for speculative, cash burning jam tomorrow companies. If anything, the bombed out valuations are indeed a hindrance now, as they simply highlight what a low opinion public market investors have of this type of company. Many more similar companies need to de-list, I’m all in favour a mass clearout. Let’s have a smaller market, with better quality companies.

However, given that delisting announcements usually trigger a c.50-75% crash in share price, it’s essential not to hold anything in our portfolios which is loss-making, cash burning, and running out of cash.

Another big red flag for potential delistings is a highly concentrated shareholder register, very much the case here at REDX –

Topps Tiles (LON:TPT)

44p (pre-market) £87m – H1 Trading Update – Paul – AMBER

Topps Tiles Plc (“Topps Group”, or the “Group”), the UK’s leading tile specialist, announces a trading update for the 26-week period ended 30 March 2024.

Graham looked at TPT on 4/1/2024, when it reported Q1 revenues were soft.

Brokers have been edging down forecasts in 2024 -

Today it says H1 revenues are down 5.9%, which is not good when so many costs (especially labour and energy) will be rising. It’s a deterioration from the -4% Q1 fall in revenues, previously reported on 4/1/2024.

Q2 was even worse, for the stores -

…like-for-like sales2 in Topps Tiles were 11.3% lower year-on-year3 in the second quarter, driven by lower footfall and volume

Gross margin was up, as expected it says.

Online growth was good.

Parkside (commercial business) improving, but only expected to trade at breakeven.

Profit warning -

…net profits were impacted by lower volumes, operating cost inflation and the impact of operational gearing, despite strong cost control throughout the period…

Group profitability in the first half of the year will be impacted by a number of factors including the weaker market, the timing of the holiday pay accrual and seasonally higher energy usage in the period. We continue to expect the Group’s profits in 2024 to be weighted towards the second half as indicated in our Q1 trading update.

Key question – how much will profit be impacted by these issues? We’re not told. At present there’s nothing on Research Tree, so I’m in the dark.

Hopefully an update note might come through, so I can quantify the problem. Until then, city insiders have an advantage in that they’ve presumably already received broker updates, but we haven’t. It’s just not a level playing field is it?

TOPT did adj EPS of 4.49p in FY 9/2023. I’d be surprised if H1 this year is above breakeven. So it’s difficult to see it achieving more than 2.0p EPS this year as a whole.

Do we value the shares on a PER basis, or write off this year as an untypical bad year, and anticipate a future earnings recovery? That’s up to each investor to decide.

UPDATE: a note from Edison has just come through, with FY 9/2024 reduced by 40% to 2.7p. It’s hoping for a rebound to 4.3p next year, so personally I wouldn’t want to pay more than 10x next year, so that’s 43p share price – which is exactly where the price is at the time of writing, c.43p. Edison reckons the shares are undervalued, but they’re paid to say that, so I’d rather rely on my own independent view!

Is it financially strong? The last balance sheet showed £20m in NTAV, although it seems to have a favourable working capital position, with trade creditors more than fully funding the inventories. Receivables and fixed assets are not large either, so overall I would say the balance sheet looks adequate, and it had £23m in net cash at 30/9/2023. Assuming that’s typical, and not window-dressed for the year end, then I’d say the finances look OK.

Paul’s opinion – the share price has only dipped slightly in early trades (writing this at 08:10), so it doesn’t seem to have panicked anyone as yet. I’m not sure why anyone would be motivated to buy today though, other than to support the share price if they’re existing holders maybe?

I’m struggling to see obvious value here. So I’ll go with AMBER.

Peel Hunt (LON:PEEL)

Down 5% to 120p (£148m) – Year End Trading Update – Paul – GREEN

Peel Hunt, a leading UK investment bank, today announces a trading update for the financial year ended 31 March 2024 (“FY24″).

Peel Hunt is probably best known for its outstanding company research. MiFiD saw to it that private investors are now denied access, because they have to charge separately for research, instead of bundling it as a package for institutions amp; high net worth (HNW) individuals.

Company headline -

Another resilient performance in challenging market conditions

Revenue for the full year is expected to be consistent with market expectations at approximately £85.5m (FY23: £82.3m), an increase of approximately 4% year-on-year despite equity capital markets remaining challenging throughout FY24. However, this was not quite sufficient to offset cost pressures and consequently we expect to report a loss for the full year broadly in line with market expectations.

RetailBook - set up by PEEL, this looks an excellent idea, aimed to provide retail investors with access to IPOs, follow-on placings, etc, on the same terms as institutions. It sounds similar to Primary Bid. Although for me, the key question is whether the city can get its act together, and actually promote some decent quality companies at reasonable prices. I fear the many disastrous floats in recent years (2021 in particular) may have killed the London IPO golden goose. Hence many of us are extremely wary of IPOs.

RetailBook received FCA approval on 2 April, so it will be interesting to see how this useful initiative pans out.

Outlook – this might be interesting for general market info purposes -

Market trading volumes remain low and ECM issuance continues to be subdued. We expect these trends to continue until there are meaningful signs of recovery in the UK economy and fund outflows reverse.

However, we continue to be active in public Mamp;A, with financial advisory mandates on both the buy and sell side.

Whilst IPO activity in the UK remains muted, there has been more activity in Europe and sentiment towards IPOs is improving in the UK, with investors increasingly willing to engage in relation to high quality companies.

That last bit is good news. People generally are too gloomy about the UK, and down cycles always reverse eventually because shares become too cheap. As with many things, the solution for low prices is low prices – demand naturally returns. My main worry is how many decent companies will be left in the UK market, once the Americans have finished buying up our best businesses?!

I think we need some sensible reforms for new listings – eg AIM needs to reform the rule whereby companies with a completely dominant major shareholder can float, and then do whatever they like with the company. Surely it needs a rule that (at least) 50% of the shares must be freely floating? Otherwise there’s not much in listing, as there won’t be any liquidity in the shares once they start trading. All too often promoters have chased the lucrative fees, but not given a second thought to liquidity after a company floats, leaving many clients disappointed with their listing. Look at how many are now leaving AIM in disgust, with the low liquidity and low valuations usually cited as signs of market failure (but are all too often companies’ own failings that they gloss over to save face!)

Paul’s opinion – both Graham and I think this is a good time to be looking for bargains in the financial sector. Although big regulatory risks have surfaced at several companies, smashing up their valuations, so I’m less keen than I was. Who knows what future regulatory risks might be lurking?

These companies are highly cyclical, so as long as they’re not losing money hand over fist in a downturn, then recovery should see profits surge again. They can make a ton of money in bull markets too, that is providing it’s not all paid out to staff – who often seem reluctant to own shares in their employers, causing a constant headwind of sellers cashing in share options at financial sector companies.

How to value PEEL shares? That’s the tricky bit, as ironically there aren’t any forecasts!

H1 showed only a very modest loss, and the guided revenues for FY 2/2024 above is about double the H1 level, so I’m guessing we’re looking at a modest loss, which isn’t a concern to me, given how awful markets are.

The last balance sheet at 30/9/2023 shows £91m NTAV, mostly liquid capital (there are large trade receivables and creditors), so it’s very healthy, and the £148m market cap is therefore more than half solidly backed by near-cash items on the balance sheet (mostly short term receivables).

We had an amazing opportunity a few months ago to buy CMC Markets (LON:CMCX) at par with its own working capital, which combined with a good recovery in trading has caused its shares to double in price this year. I don’t see PEEL being a bargain of that extent, but once the London market comes alive again, it could demonstrate a big, operationally geared recovery in profits. PEEL floated at 228p in Sept 2021. So being asked to pay 120p now is looking more appealing. I’ve just thumbed through the AIM Admission Document, and note that PEEL was staggeringly profitable in FY 3/2021, making £74m illustrative adj PBT, more than 10x the £7.1m more normal profit pre-pandemic in FY 3/2019. So there’s an astonishingly wide range of potential profit levels. No wonder they went for an over-priced float later in 2021! Canny selling shareholders pocketed £69m in the float.

Overall, it’s tempting. Graham usually reviews PEEL and has been green in the past due to its balance sheet strength, and the recovery potential. That seems a sensible view to me too, so I’m happy to leave it at GREEN.

Calnex Solutions (LON:CLX)

Down 3% to 57p (£50m) – Trading Update – Paul – AMBER

Calnex Solutions plc (AIM: CLX), a leading provider of test and measurement solutions for the global telecommunications and cloud computing markets, provides an update on trading for the year to 31 March 2024 (“FY24″) and outlook for FY25.

Results slightly below expectations -

Calnex anticipates the results for FY24 will be broadly in line with market expectations, with revenues of approximately £16.3 million and margins maintained. The Company’s cost base has been adjusted, maintaining and focusing Ramp;D spend to capitalise on the opportunities available to Calnex whilst controlling other costs. The Group’s balance sheet remains strong, with cash as at 31 March 2024 of £11.9 million after investment in working capital in H2.

Cavendish has trimmed its forecasts from a £(0.1)m PBT loss, to £(0.4)m. This isn’t some jam tomorrow story stock though. Calnex was previously an attractive-looking growth company, in particular note the decent growth, and high profit margins reported in previous years. Then it all crashed in the current financial year, FY 3/2024, blamed on industry-wide factors which also clobbered the performance of Spirent Communications (LON:SPT) – which has since attracted two takeover bids.

Outlook – nothing specific, other than that it feels well placed to return to growth. There’s also some technical stuff in today’s update about expanding into different markets, cloud computing, and opportunities for 5G.

Cavendish hopes for a small loss in FY 3/2024 to improve into a small profit in FY 3/2025, but nowhere near the previous levels of profitability achieved.

I don’t feel I can usefully assess what the future holds, as there isn’t really any firm information on it, and I don’t have any sector knowledge, so buying this share would just be a punt for me.

Balance sheet – is excellent. Last reported on 30 Sept 2023, it had NTAV of £13.6m, including net cash of £13.5m. Note that cash has come down to £11.9m as at 31/3/2024. Still ample, I’d say, so not a cause for concern.

Although looking at the H1 cashflow statement, it was negative at £(4.1)m, which seems a significant cash outflow considering the Pamp;L was showing not much worse than breakeven. I see it capitalised £2.55m in Ramp;D in H1, so it looks like the cash numbers are worse than the Pamp;L figures. So maybe shareholders shouldn’t get too comfortable with the cash position, as it keeps dropping?

Paul’s opinion – it seems unlikely that the strong previous track record has just vanished, particularly given well-known telecoms sector problems. That said I have no way of knowing the extent, or timing, of any recovery. For that reason it would be total guesswork for me trying to value this share. It has to go into the “don’t know” tray. Given the excellent track record before this year, and the solid balance sheet, I think AMBER makes sense for me.

Source: https://www.stockopedia.com/content/small-cap-value-report-weds-3-april-2024-sdry-redx-tpt-peel-clx-993720/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Please Help Support BeforeitsNews by trying our Natural Health Products below!

Order by Phone at 888-809-8385 or online at https://mitocopper.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomic.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomics.com M - F 9am to 5pm EST

Humic & Fulvic Trace Minerals Complex - Nature's most important supplement! Vivid Dreams again!

HNEX HydroNano EXtracellular Water - Improve immune system health and reduce inflammation.

Ultimate Clinical Potency Curcumin - Natural pain relief, reduce inflammation and so much more.

MitoCopper - Bioavailable Copper destroys pathogens and gives you more energy. (See Blood Video)

Oxy Powder - Natural Colon Cleanser! Cleans out toxic buildup with oxygen!

Nascent Iodine - Promotes detoxification, mental focus and thyroid health.

Smart Meter Cover - Reduces Smart Meter radiation by 96%! (See Video).