Analysis time: APPL and it’s bearish turn

Apple Inc. (NASDAQ:AAPL) is an American tech giant, a real heavyweight in the global corporate scene. The company is known for its innovative gadgets, such as the iPhone, iPad, and Macbook, not to mention its nifty software, like the iOS operating system.

Apple has recently reported its third-quarter results for fiscal year 2023. Revenue reached a record high of $21 billion, which is a solid 8.2% rise. Such growth is attributed to more than a billion paid subscriptions to music and TV streaming services, plus software sales through the Apple Store. However, it is alarming that the segment’s growth rate has taken a bit of a dive: in 2021, they were growing at a whopping 27.3%. In 2022 this number was almost half as big – 14.2%, and by the end of the first half of 2023, the rate diminished to a mere 6.7%. Experts think it might pick up again to around 14%, but it’s a bit too early to say for sure.

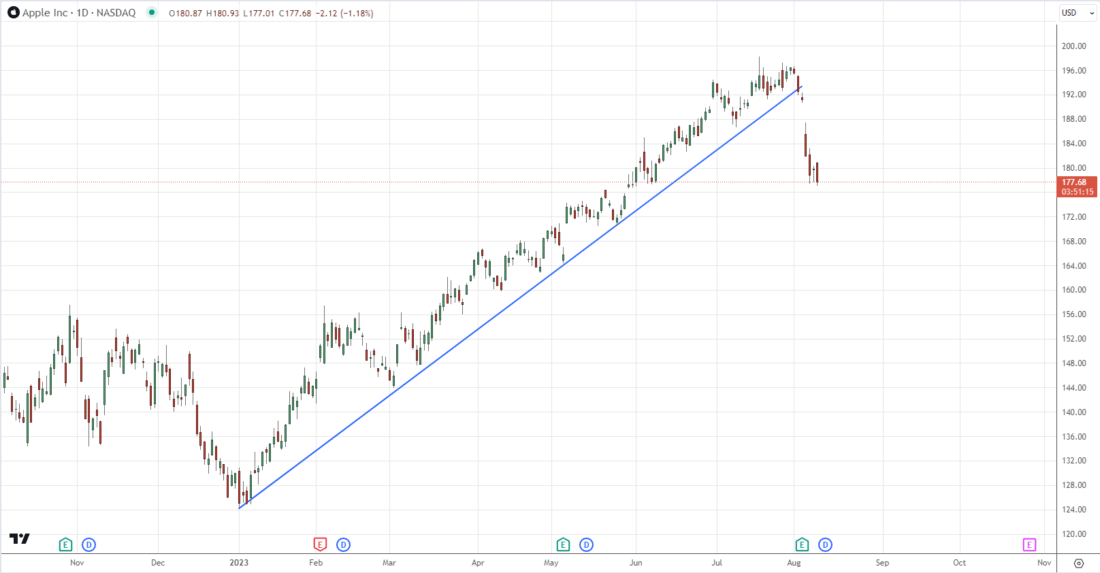

The company managed to reach the $3 trillion mark of capitalization. Nevertheless, for the second week in a row, the company’s been seeing a drop in its stock price. With the profit report released on August 3, this trend got more pronounced. It got so intense that the trend line got broken, and sellers began to act pretty aggressively.

The main factor for the current slide is the decline in the smartphone market along with increased competition, especially from Asian companies, and the tightening of antitrust regulation, which has become a priority in the US. Speaking of the smartphone market, we can observe a certain correlation. After the boost triggered by the pandemic, the market had to slow down and saturate itself with new gadgets and tech, a people need time to adjust to new systems before they’re ready to embrace the next ones. The market has been flooded with options. Therefore, the purchasing power has decreased. After Covid, most smartphone manufacturers tried to regain their pre-pandemic production rates as quickly as possible. Some companies managed it, some didn’t, but overall the market started gaining momentum.

Apple is one of those companies that sells the same candy in a different wrapper, presenting it as something revolutionary. Though most are aware of this trick, they still fall for it sometimes. Nevertheless, the sales data hasn’t been great, and the company is forced to prematurely suspend the production of less popular models, which consequently affects the indicators and revenue. A good example is the Mini lineup models, which posted the worst sales results in the company’s history. The global appetite for electronics is kind of weak, which led to a 2.4% drop in iPhone revenue and a 7.3% slump in Mac sales. Still, the number of active Apple devices hit a new high during the June quarter.

However, there are a bunch of investors who still have faith in Apple stock, and here’s why. The current decline slowed down right around the critical support level of $177. This level is a mirror one – previously, it acted as a strong resistance and restrained growth, but after a previous drop and then a surge, the price finally managed to break through it. Thus, a rollback is regarded as an expected correction, and the level itself is a zone of interest for major players. Although, most often, after a stop, a slight lateral movement follows to accumulate volumes. The accumulation helps establish a balance between supply and demand. And the presentation of new devices this fall is likely to give things a boost. Roughly speaking, the market froze in anticipation of the following “breakthrough” technologies to keep the growth going.

The probability that the level will give way remains, but in this case, sellers will have to face the historical accumulation that formed back when the level was resistance. If that happens, all eyes would be on it and around the $150 area.

Major players are already showing confidence in continued growth. For example, Berkshire Hathaway, whose investment portfolio includes Apple stock worth $177.6 billion.

And there’s another thing messing with Apple’s sales figures: the almighty dollar. You see, a good chunk of their revenue comes from abroad. Apple’s CEO, Tim Cook, and its CFO, Luca Maestri, have mentioned that if the exchange rate of the US currency doesn’t change, their sales should still show some year-on-year growth.

From all of the above, it seems reasonable to say that the chances of the shares continuing to drop are notably lower than the continuation of growth after a rebound from the current support. The stability in the reported figures and the upcoming presentation of new devices hold key importance in stirring up the market.

In addition, the company plans to continue investing in AI and augmented reality-related developments. The projects that didn’t quite hit the mark, like the Apple Vision Pro, haven’t been entirely abandoned, and we have yet to see the real revolution. After all, Apple is not the sort of company that gives up on its projects, especially expensive ones but squeezes as much as possible out of them.

When you put all these pieces together, it’s a strong indication that Apple maintains its status as a leader and one of the most triumphant companies in the realm of technology, both nationally and across the globe. Their achievements owe a great deal to their products and the strategic path they’ve chosen.

Read more about CAD, product design and related technology at SolidSmack.com

Source: https://www.solidsmack.com/business/analysis-time-appl-and-its-bearish-turn/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Please Help Support BeforeitsNews by trying our Natural Health Products below!

Order by Phone at 888-809-8385 or online at https://mitocopper.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomic.com M - F 9am to 5pm EST

Order by Phone at 866-388-7003 or online at https://www.herbanomics.com M - F 9am to 5pm EST

Humic & Fulvic Trace Minerals Complex - Nature's most important supplement! Vivid Dreams again!

HNEX HydroNano EXtracellular Water - Improve immune system health and reduce inflammation.

Ultimate Clinical Potency Curcumin - Natural pain relief, reduce inflammation and so much more.

MitoCopper - Bioavailable Copper destroys pathogens and gives you more energy. (See Blood Video)

Oxy Powder - Natural Colon Cleanser! Cleans out toxic buildup with oxygen!

Nascent Iodine - Promotes detoxification, mental focus and thyroid health.

Smart Meter Cover - Reduces Smart Meter radiation by 96%! (See Video).