China’s Real Estate Crisis: A New Experiment In State Intervention

The real estate market is responsible for anywhere from 20% to over 30% of China’s GDP (depending on who you ask). And with the latest meltdown that began with the implosion of Evergrande, the situation just keeps getting worse, inspiring a slew of government interventions beyond the scope of what would be possible in a country like the US.

It’s a test of China’s authority, and its ability to micromanage what was mismanaged from the start. With China’s real estate stocks down 20% since May can the CCP, in all its centralized power, prevent a full meltdown?

China may succeed in kicking the can down the road, but it can’t save the real estate market — or economy — in the long term. Either way, history indicates that the current drawdown likely still has a long way down to go.

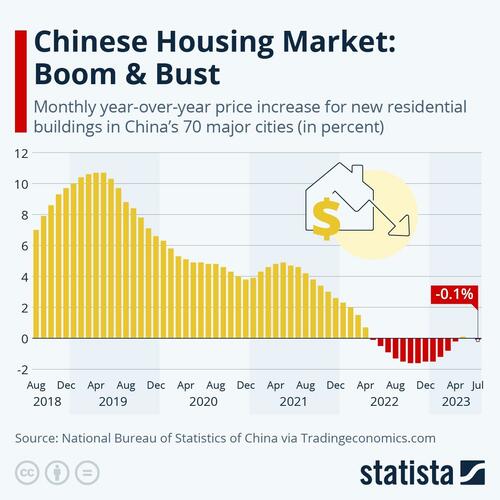

This chart shows a run-up to the current route, not long before the liquidation calls began for Evergrande and Country Garden and set the latest RE spiral into motion:

You will find more infographics at Statista

The People’s Bank of China can directly inject liquidity into a struggling sector. But state-owned companies also get to buy properties at government-set prices. The state and central bank can also change mortgage rates and payment requirements directly, unlike in the US where banks react to the federal funds rate set by the Fed. China is also loosening general restrictions on who is allowed to buy a home, hoping to juice the market and reduce vacancies, but there’s a potential catch-22 inherent to all such historic-level interventions:

If they stoke concerns among consumers and investors that the crisis is something to be deeply worried about, this can fuel a self-fulfilling feedback loop that worsens investor confidence even further.

Meanwhile, home buyers who fit the previously stringent criteria for buying homes feel duped now that those restrictions have been eased, devaluing their social status and the work they put into the home-buying process. With many complexes now having their unsold buildings turned into public housing, citizens who saved up their whole lives to become homeowners in these areas are becoming enraged to discover that their complexes will now be subsidized. Not only does that mean they paid too much, but their home’s attractiveness as a longer-term investment could drop.

According to Goldman Sachs, the current interventions still aren’t enough. A recent report calls for more liquidity to the tune of $276 billion (¥2 trillion yuan) to stabilize housing in major mainland cities, with ¥20 trillion yuan worth of real estate in need of a savior.

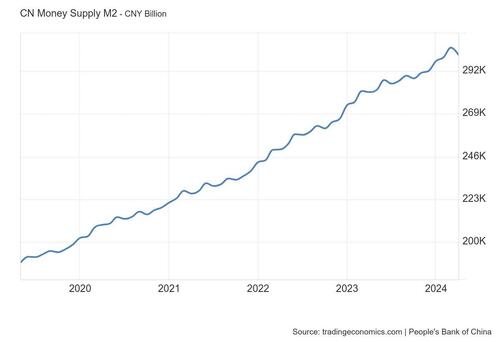

This liquidity would be meant to stop prices from continuing to plummet and allow over-indebted developers to pay back loans and interest. But in a market in need of such an intervention, even once prices stop plummeting, many become rightfully hesitant to become buyers. The below chart of China’s M2 money supply shows a dip in April 2024. It will be interesting to take another look after China’s intervention floods the economy with $500 billion yuan worth of relending programs.

To make matters worse in the longer term, declining birthrate and an aging population both indicate that demand is not going to pick back up enough to fill the apartments and houses built during China’s decades-long urbanization frenzy. This is a generational problem that goes beyond a single crash, liquidation, or bankruptcy — and can’t be properly fixed with centralized market interventions. Beyond that, even people in their prime home-buying age are more worried about future earnings than they used to be, without the feverish demand for urban homes that characterized so much of China’s rise to a global economic power.

In a free market, nature determines the winners and losers. But in a command-and-control economy, the State gets to decide. And when the interventions brazenly defy economic reality, as central banks always do, everyone ends up losing in the end. That is, except for the central bank, the government, and their preferred cronies, who will be the ones who get the free money and the bailouts when it all comes crashing down.

Tyler Durden Tue, 06/11/2024 – 19:40

Source: https://freedombunker.com/2024/06/11/chinas-real-estate-crisis-a-new-experiment-in-state-intervention/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Humic & Fulvic Liquid Trace Mineral Complex

HerbAnomic’s Humic and Fulvic Liquid Trace Mineral Complex is a revolutionary New Humic and Fulvic Acid Complex designed to support your body at the cellular level. Our product has been thoroughly tested by an ISO/IEC Certified Lab for toxins and Heavy metals as well as for trace mineral content. We KNOW we have NO lead, arsenic, mercury, aluminum etc. in our Formula. This Humic & Fulvic Liquid Trace Mineral complex has high trace levels of naturally occurring Humic and Fulvic Acids as well as high trace levels of Zinc, Iron, Magnesium, Molybdenum, Potassium and more. There is a wide range of up to 70 trace minerals which occur naturally in our Complex at varying levels. We Choose to list the 8 substances which occur in higher trace levels on our supplement panel. We don’t claim a high number of minerals as other Humic and Fulvic Supplements do and leave you to guess which elements you’ll be getting. Order Your Humic Fulvic for Your Family by Clicking on this Link , or the Banner Below.

Our Formula is an exceptional value compared to other Humic Fulvic Minerals because...

It’s OXYGENATED

It Always Tests at 9.5+ pH

Preservative and Chemical Free

Allergen Free

Comes From a Pure, Unpolluted, Organic Source

Is an Excellent Source for Trace Minerals

Is From Whole, Prehisoric Plant Based Origin Material With Ionic Minerals and Constituents

Highly Conductive/Full of Extra Electrons

Is a Full Spectrum Complex

Our Humic and Fulvic Liquid Trace Mineral Complex has Minerals, Amino Acids, Poly Electrolytes, Phytochemicals, Polyphenols, Bioflavonoids and Trace Vitamins included with the Humic and Fulvic Acid. Our Source material is high in these constituents, where other manufacturers use inferior materials.

Try Our Humic and Fulvic Liquid Trace Mineral Complex today. Order Yours Today by Following This Link.