ECB Preview And Scenario Analysis: The First Rate Cut Since 2019

Hot on the heels of the first G7 central bank rate cut this cycle, when the BOC cut rates by 25bps this morning, tomorrow the ECB is widely expected to follow suit and lower the deposit rate from 4.00% to 3.75% for the first time since September 2019, with markets assigning a 94% chance to this outcome. With a rate cut effectively guaranteed (absent some shock) focus will be on hints over future rate cuts, with markets not fully pricing in another move until December. Changes to staff projections are likely to be minimal. In their preview, Bank of America strategists agree that a 25bps rate cut is coming, and expect “a lot more to come by mid-2025.” That said, guidance for a meeting-by-meeting approach and data dependence probably won’t change. Small forecast revisions higher to 2024/25 are likely, but 2% core inflation in 2026 should stay, providing a soft signal to a September cut, data permitting.

In rates markets, a cut by the European Central Bank on Thursday is already fully baked into the curve, with forward pricing nearly 25bp. But as ING Economics notes, it’s the outlook beyond June that is still open, despite communication from officials having started to move out the curve. A back-to-back cut in July is deemed unlikely, with markets attaching only a roughly 10% chance to that scenario. A second cut is almost fully priced by October, but it’s a third cut this year that is hanging in the balance. The pricing further out the curve is also influenced by drivers from abroad: weaker US data as well as sliding oil prices have also helped push rates lower in the eurozone. While EUR markets have been leaning towards a three-cut scenario for this year again, the domestic data on negotiated wages and the latest CPI print over the past weeks would argue for a more hawkish line at the upcoming meeting.

Therefore, there is room for markets to reprice higher – but in the end, they will oscillate around the two or three-cuts scenario for now unless we get more evidence from the data. This will also spill out into the longer end of the curve, but here the factors from abroad should be felt even more with the US jobs data looming large. This will then determine whether we can get above 2.6% more lastingly in the 10Y Bund yield on a hawkish ECB.

Courtesy of Newsquawk, here are some other key considerations ahead of the ECB’s first rate cut in five years:

PRIOR MEETING: As expected, the ECB opted to stand pat on rates once again. The policy statement reaffirmed guidance that rates will be kept sufficiently restrictive for sufficiently long. Furthermore, policymakers will continue to follow a data-dependent and meeting-by-meeting approach and will not pre-commit to a particular rate path. That being said, and what was a new inclusion for the statement, it was noted that if the Governing Council was to gain further confidence that inflation is converging to the target in a sustained manner, it would be appropriate to reduce the current level of monetary policy restriction. In the follow-up press conference, when questioned about a potential rate cut in June, Lagarde reiterated that the ECB will have a lot more data by the time of the June meeting. In terms of the unanimity of the announcement, Lagarde stated that “a few” dissenters felt “sufficiently confident” about altering policy at the meeting, however, they ultimately rallied around the consensus. This could potentially be in-fitting with source reporting in the wake of the previous meeting which suggested some policymakers floated the idea of a second cut in July to win over a small group still pushing for an April start.

RECENT ECONOMIC DEVELOPMENTS: In terms of developments since the prior meeting, inflation in May rose to 2.6% from 2.4% with the super-core measure increasing to 2.9% from 2.7% with some of the increases related to base effects. The ECB’s consumer expectations survey for April saw the 12-month inflation forecast nudge lower to 2.9% from 3.0%. For market gauges, the 5y5y forward has ticked marginally higher from 2.35% to 2.36%. Elsewhere, Q1 Eurozone wages rose to 4.69% from 4.45% with the release followed up by an ECB blog stating that “wage growth reflects multiyear adjustment and wage pressures look set to decelerate in 2024”. From a growth perspective, Q1 GDP came in at 0.3% Q/Q vs. prev. 0.0%, whilst more timely survey data showed the EZ-composite PMI moved further into expansionary territory (52.3 vs. prev. 51.7) thanks to a pick up in the manufacturing sector. The accompanying report noted “considering the PMI numbers in our GDP nowcast, the Eurozone will probably grow at a rate of 0.3% during the second quarter, putting aside the spectre of recession”. Elsewhere, the EZ unemployment rate sits at a historic low of 6.4%.

RECENT COMMUNICATIONS: Rhetoric since the April meeting has seen President Lagarde remark that the ECB will cut rates soon, barring any major surprises, whilst she is “really confident” that they have inflation under control. Chief Economist Lane noted that keeping rates overly restrictive for too long could push inflation below target in the medium-term which would require corrective action. Furthermore, he notes that the ECB thinks inflation over the coming months will bounce around at the current level and then will see another phase of disinflation bringing them back to the target later next year. Thought-leader Schnabel of Germany remarked that some elements of inflation are proving persistent and would caution against moving too fast on rates. At the hawkish end of the spectrum, Austria’s Holzmann has tried to make the case for pausing the July meeting, whilst Netherland’s Knot has stated that projection round meetings will be the key for interest rate decisions. For the doves, Italy’s Panetta commented that the ECB must weigh risk of monetary policy becoming too tight, adding that timely and small rate cuts would counter weak demand, whilst Greece’s Stournaras is of the view that three rate cuts are more likely this year.

RATES: Expectations are for the ECB to lower the deposit rate for the first time since September 2019. Analysts are unanimous in their view that the deposit rate will be lowered from 4.0% to 3.75% with markets assigning a roughly 94% chance of such an outcome. With a 25bps cut so widely expected, the fight on the GC between the hawks and doves will be what comes thereafter with the former likely to make the case for pausing on rates in July given potential emerging upside risks to inflation, whilst the latter is set to argue that keeping policy too tight could push inflation below target. As such, any tweaks to the policy statement, hinting at further action will be of note to the market. Accordingly, focus for the release will be on how pricing beyond June evolves with the next rate cut thereafter not fully priced until December (total of 56bps of cuts seen by year-end). However, ING cautions that given the data dependency of the Bank, this debate is unlikely to be resolved in June.

MACRO PROJECTIONS: For the accompanying macro projections, ING notes that since the prior forecast round in March, oil prices have risen (from roughly USD 75/bbl at the time), which would be pro-inflationary. However, offsetting this, is the more hawkish market curve which sees around 113bps of cuts by the end of 2025 vs. around 150bps in March. Overall, the bank expects “a slight upward revision of growth and inflation for this year but no changes to the profile and the timing of inflation dropping below 2%”. That being said, economists at the Bank note “the risks of inflation remaining sticky and not being entirely under control are increasing”.

March staff projections

HICP INFLATION:

- 2024: 2.3% (exp. 2.4%)

- 2025: 2.0% (exp. 2.1%)

- 2026: 1.9% (exp. 2.0%)

HICP CORE INFLATION (EX-ENERGY & FOOD):

- 2024: 2.6%

- 2025: 2.1%

- 2026: 2.0%

GDP:

- 2024: 0.6% (exp. 0.7%)

- 2025: 1.5% (exp. 1.4%)

- 2026: 1.6% (exp. 1.4%)

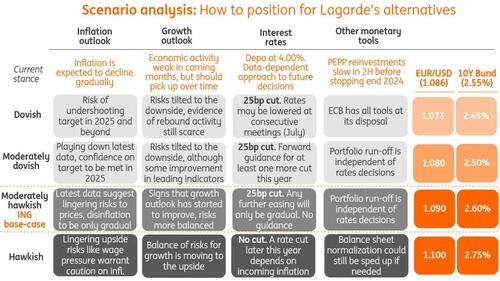

Finally, courtesy of ING, here is a scenario analysis laying out how to position for the various alternatives:

Tyler Durden Wed, 06/05/2024 – 22:52

Source: https://freedombunker.com/2024/06/05/ecb-preview-and-scenario-analysis-the-first-rate-cut-since-2019/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Humic & Fulvic Liquid Trace Mineral Complex

HerbAnomic’s Humic and Fulvic Liquid Trace Mineral Complex is a revolutionary New Humic and Fulvic Acid Complex designed to support your body at the cellular level. Our product has been thoroughly tested by an ISO/IEC Certified Lab for toxins and Heavy metals as well as for trace mineral content. We KNOW we have NO lead, arsenic, mercury, aluminum etc. in our Formula. This Humic & Fulvic Liquid Trace Mineral complex has high trace levels of naturally occurring Humic and Fulvic Acids as well as high trace levels of Zinc, Iron, Magnesium, Molybdenum, Potassium and more. There is a wide range of up to 70 trace minerals which occur naturally in our Complex at varying levels. We Choose to list the 8 substances which occur in higher trace levels on our supplement panel. We don’t claim a high number of minerals as other Humic and Fulvic Supplements do and leave you to guess which elements you’ll be getting. Order Your Humic Fulvic for Your Family by Clicking on this Link , or the Banner Below.

Our Formula is an exceptional value compared to other Humic Fulvic Minerals because...

It’s OXYGENATED

It Always Tests at 9.5+ pH

Preservative and Chemical Free

Allergen Free

Comes From a Pure, Unpolluted, Organic Source

Is an Excellent Source for Trace Minerals

Is From Whole, Prehisoric Plant Based Origin Material With Ionic Minerals and Constituents

Highly Conductive/Full of Extra Electrons

Is a Full Spectrum Complex

Our Humic and Fulvic Liquid Trace Mineral Complex has Minerals, Amino Acids, Poly Electrolytes, Phytochemicals, Polyphenols, Bioflavonoids and Trace Vitamins included with the Humic and Fulvic Acid. Our Source material is high in these constituents, where other manufacturers use inferior materials.

Try Our Humic and Fulvic Liquid Trace Mineral Complex today. Order Yours Today by Following This Link.