Turkey Unexpectedly Hikes Lending Rate In Scramble To Prop Up Crashing Lira

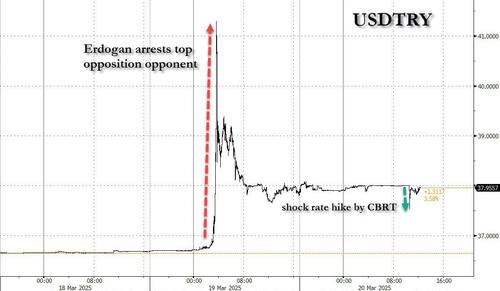

Just as Wall Street had gotten all bulled up on Turkey, urging clients to buy the lira (countless previous rugpulls of carry traders notwithstanding) amid expectations of easing inflation, declining interest rates, and a generally pro-market posture, Erdogan stunned everyone on Wednesday by sparking the biggest meltdown in the currency and Turkish markets in years when he arrested his chief opposition challenger for the presidential post, confirming yet again that Turkey is the biggest banana republic in the emerging market universe by far (because Erdogan believes he is untouchable by Western nations as he has become the most important force in Europe thanks to his massive military, which is the second largest in NATO).

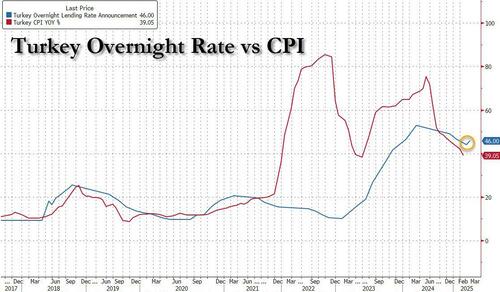

And then, moments ago Turkey pulled shocker number 2 in 24 hours, when the Turkish central bank shocked the market again when it raised its overnight lending rate by two percentage points in a surprise meeting on Thursday to support the lira and mitigate the impact from the currency’s sudden decline on inflation.

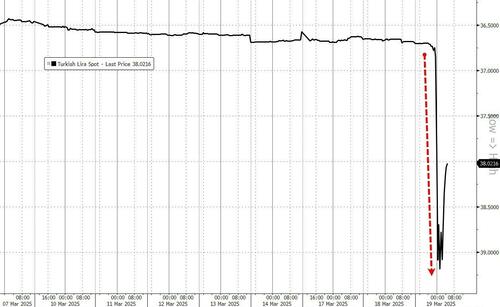

The rate hike came a day after the currency lost as much as 11% amid political turmoil triggered by the detention of a major opposition politician. And, as shown in the chart below, it has done absolutely nothing to restore confidence in the policies of this banana republic, with the USDTRY promptly back to where it was before the rate hike.

“Assessing the risks that these developments may pose to the inflation outlook, measures have been taken to support the tight monetary stance,” the bank said in a statement on its website. The “monetary policy stance will be tightened in case a significant and persistent deterioration in inflation is foreseen.”

While policymakers left their benchmark, one-week repo rate unchanged at 42.5%, the increase in the overnight rate to 46% would allow them to raise the average cost of funding they provide to commercial lenders, and help further tighten financial conditions. The move is also meant to make fudning of lira shorts more expensive.

After Turkish assets posted the world’s biggest losses on Wednesday, including an 8% crash in the stock market which triggered a marketwide circuit breaker, markets showed some signs of stabilization on Thursday, largely thanks to $8 billion in USD sales by the central bank meant to prop up the lira. The only problem is that the CBRT is chronically cash-strapped and as such it will be unable maintain intervention once foreigners lose all faith in the local market, where rates paid on FX positions are an unsustainable 42%, yet with inflation running even higher, Turkey has no choice.

“It is the confirmation of the central bank’s credibility and that yesterday’s events are more political than a change in the orthodox policies implemented since 2023,” said Guillaume Tresca, an emerging-markets strategist at Generali Investments, who was clearly long Turkey and was hoping his soothing words would convince someone.

Meanwhile, expectations that the monetary authority could slow down or pause its rate cuts saw investors sell banking shares, with Turkish lenders’ equities dropping as much as 9% on Thursday.

Tyler Durden Thu, 03/20/2025 – 12:55

Source: https://freedombunker.com/2025/03/20/turkey-unexpectedly-hikes-lending-rate-in-scramble-to-prop-up-crashing-lira/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Before It’s News® is a community of individuals who report on what’s going on around them, from all around the world. Anyone can join. Anyone can contribute. Anyone can become informed about their world. "United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

LION'S MANE PRODUCT

Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules

Mushrooms are having a moment. One fabulous fungus in particular, lion’s mane, may help improve memory, depression and anxiety symptoms. They are also an excellent source of nutrients that show promise as a therapy for dementia, and other neurodegenerative diseases. If you’re living with anxiety or depression, you may be curious about all the therapy options out there — including the natural ones.Our Lion’s Mane WHOLE MIND Nootropic Blend has been formulated to utilize the potency of Lion’s mane but also include the benefits of four other Highly Beneficial Mushrooms. Synergistically, they work together to Build your health through improving cognitive function and immunity regardless of your age. Our Nootropic not only improves your Cognitive Function and Activates your Immune System, but it benefits growth of Essential Gut Flora, further enhancing your Vitality.

Our Formula includes: Lion’s Mane Mushrooms which Increase Brain Power through nerve growth, lessen anxiety, reduce depression, and improve concentration. Its an excellent adaptogen, promotes sleep and improves immunity. Shiitake Mushrooms which Fight cancer cells and infectious disease, boost the immune system, promotes brain function, and serves as a source of B vitamins. Maitake Mushrooms which regulate blood sugar levels of diabetics, reduce hypertension and boosts the immune system. Reishi Mushrooms which Fight inflammation, liver disease, fatigue, tumor growth and cancer. They Improve skin disorders and soothes digestive problems, stomach ulcers and leaky gut syndrome. Chaga Mushrooms which have anti-aging effects, boost immune function, improve stamina and athletic performance, even act as a natural aphrodisiac, fighting diabetes and improving liver function. Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules Today. Be 100% Satisfied or Receive a Full Money Back Guarantee. Order Yours Today by Following This Link.